Introduction:

In the constantly changing world of investing options, investors looking for a professionally managed and diversified portfolio are increasingly turning to mutual funds. One subset of mutual funds, called Flexi Cap Funds, provides a special combination of growth potential and flexibility.

The Flexibility Factor:

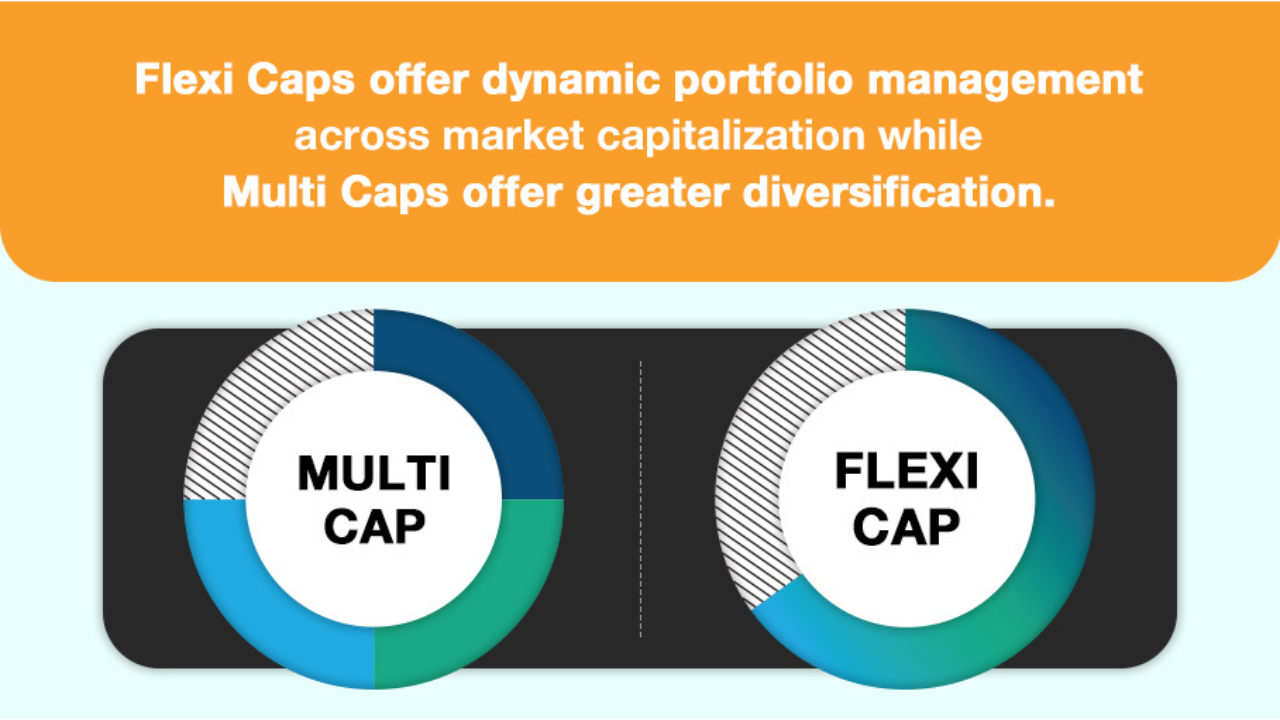

As the name suggests, Flexi Cap funds are characterized by flexibility in choosing investments with different market values. Unlike other equity funds that have specific mandates such as large, mid, or small, Flexi Cap funds have the freedom to dynamically allocate their assets based on market conditions. Thanks to this adaptability, fund managers can navigate different market phases and take advantage of new opportunities.

Market Cap Freedom:

One of the main features of Flexi Cap Funds is their ability to invest in companies of various sizes, including large, medium, and small companies. This flexibility allows fund managers to make strategic adjustments to changing market conditions. In a bullish phase, they can add mid-cap and small-cap stocks for greater growth potential, while in a bear market, they can shift to large-cap stocks for stability.

Active Management Advantage:

Flexi Cap funds are actively managed, meaning that fund managers make decisions based on market trends, economic conditions, and the performance of individual stocks. This active management style aims to outperform the benchmark by taking advantage of investment opportunities and hedging risks. This is different from passive funds, such as index funds, which try to track the performance of a specific index.

Diversification Dynamics:

Diversification is a key principle of an investment strategy and Flexi Cap funds by their very nature offer high diversification. By investing in different market values and sectors, these funds spread risk and reduce the impact of underperforming stocks on the entire portfolio. Such diversification can increase return potential while managing downside risk.

Considerations for Investors:

Before diving into Flexi Cap funds, investors need to consider their risk tolerance, investment objectives, and time horizon. While the flexibility of these funds can be an advantage, it also requires the comfort of potentially higher volatility compared to more conservative investment options.

Investors should also assess the fund’s experience and expertise. The success of the Flexi Cap fund largely depends on the manager’s ability to make informed investment decisions in response to market dynamics.

Conclusion:

Flexi Cap funds offer a dynamic and adaptive approach to equity investment, offering the potential for attractive returns through a mix of large, mid, and small caps. Flexibility and an active management style make these funds suitable for the investor looking for a balance between growth potential and risk management. However, as with any investment, it is important that investors do their due diligence, understand their financial goals and consult with financial professionals before making investment decisions. As with all investments, past performance is not indicative of future performance, and prudent investors should use due diligence to make informed choices in their financial journey.